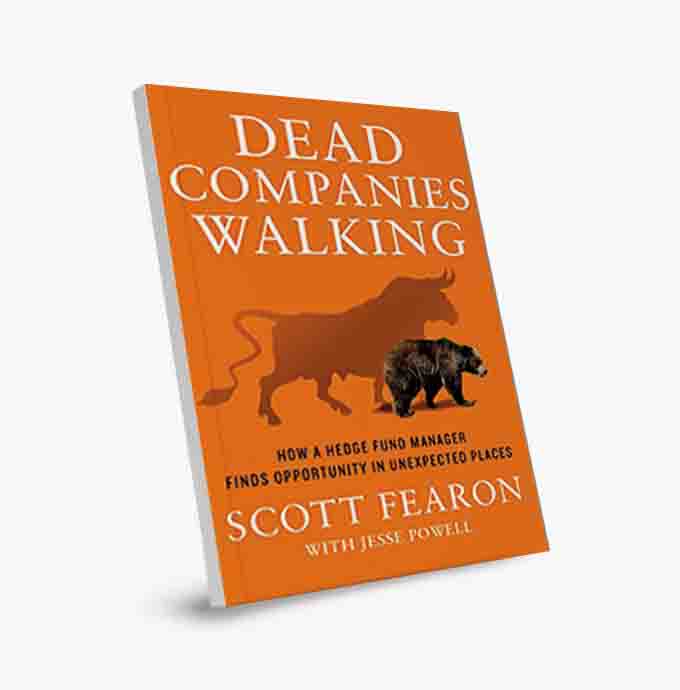

from Scott Fearon, Jesse Powell

Finance

In "Dead Companies Walking," Scott Fearon masterfully decodes the intricacies of business failure, offering a unique lens on short selling and corporate behavior. His insights into market analysis, corporate downfall, and financial metrics are crucial for understanding the challenges and opportunities in today’s dynamic business landscape. This book is an entertaining read for those invested in strategic decision-making, business leadership, and those grasping the essence of entrepreneurial success.

"As the manager of my hedge fund, I’ve shorted the stocks of over two hundred companies that have eventually gone bankrupt. Many of these businesses started out with promising, even inspired ideas..." Scott Fearon, Dead Companies Walking

BRIEF BOOK SUMMARY

"Dead Companies Walking" by Scott Fearon offers a unique perspective on identifying failing businesses and the lessons entrepreneurs and business leaders can learn from them. The book's central premise revolves around Fearon's experiences as a hedge fund manager specializing in short selling – betting against companies he believes are on a downward trajectory. Fearon distills his experiences into key insights, revealing how even promising companies can falter and fail.

One of the critical lessons from Fearon’s experiences is the importance of understanding consumer behavior and market realities. Fearon highlights cases like JCPenney, where a failure to grasp customer preferences led to strategic missteps. This underscores the need for businesses to stay closely connected with their consumer base and to be wary of assumptions that may not align with actual customer needs and behaviors. Fearon's approach goes beyond traditional financial analysis, focusing on the qualitative aspects of business operations and market dynamics.

Fearon also delves into the concept of “Executive Antilogic” and “Digging Trenches Syndrome,” using examples like Blockbuster to illustrate how companies often fail to adapt to changing market conditions. This notion stresses the importance of flexibility and innovation in business strategy. Entrepreneurs and business leaders are cautioned against clinging to outdated models or strategies, emphasizing the need for adaptability in an ever-evolving business landscape.

Another significant aspect of Fearon's methodology is the emphasis on direct interaction with company management. Fearon argues that much can be learned about a company's potential and its possible pitfalls through these interactions. He encourages entrepreneurs and leaders to engage deeply with their teams and to understand the real dynamics driving their businesses, beyond what is evident in financial statements and reports.

Fearon warns against the dangers of historical myopia and over-reliance on recent trends when making business and investment decisions. He advocates for a broader historical perspective and cautions against the pitfalls of confirmation bias, where investors or business leaders might only see what they want to see, ignoring contrary information. This approach is particularly relevant in today’s fast-paced and often hype-driven business environment

Lastly, "Dead Companies Walking" serves as a guide for recognizing the signs of a failing business. Fearon’s insights extend beyond the realm of investment to offer valuable lessons for business strategy, leadership, and market analysis. He highlights the importance of understanding customer needs, being adaptable, engaging with management, avoiding confirmation bias, and recognizing when industry shifts demand a change in strategy. These lessons are crucial for savvy freelancers, entrepreneurs, intrapreneurs, and business leaders, providing tools for deep learning and strategic decision-making in various professional contexts.

WHY SHOULD YOU READ THIS BOOK? By Francisco Santolo

I enjoyed Scott Fearon's approach to short selling, which is based on conducting in-depth interviews and empathizing with the mental models, reasoning, and viewpoints of key decision-makers. This method reflects the entrepreneurial strategy of identifying customer needs through active listening and relationship development. Entrepreneurs, just like Fearon in his analysis, must dive deep into understanding the pains, gains, motivations, and behaviors of their potential customers. This methodology is not just about listening but also about asking the right questions, often open-ended, to truly understand the underlying dynamics of a market or a company.

Fearon's technique is a lesson in the importance of going beyond superficial indicators such as financial metrics. In my experience, the true essence of a business's potential and the roots of its challenges lie in the minds of those who lead it. By engaging directly with these leaders, just as Fearon does, one can gain insights that are often overlooked in conventional market analysis. This approach is particularly relevant in entrepreneurship, where understanding the nuances of a problem and the mindset of the customer or client can make the difference between a solution that truly addresses a need and one that misses the mark.

Adaptability in business strategy, another key theme of the book, is particularly relevant in today's rapidly evolving market landscape. The story of Blockbuster's fall due to its inability to adapt to digital trends is a stark reminder of the need for flexibility and openness to change in business models.

For entrepreneurs, this translates into maintaining humility and cultivating the ability to foresee market changes, changes in customer behavior, and even internal company challenges before they become evident to the competition. It's about reading between the lines, understanding not just what is said, but what is not said: the hesitations, assumptions, and beliefs that drive decisions and actions in business players.

Fearon's deep analysis, which goes beyond financials to understand the real dynamics of businesses, is a methodology I find particularly effective. This depth of analysis, especially in assessing the quality of company management, is crucial for uncovering hidden insights about a company's potential and pitfalls, mirroring the depth of research and analysis required in successful entrepreneurship.

The lessons offered by "Dead Companies Walking," especially in the realm of probing the mental models of decision-makers, are invaluable for anyone in the field of business, particularly for entrepreneurs seeking to innovate and create solutions that resonate deeply with their customers. Fearon's book is a powerful reminder that the key to business success often lies in the ability to listen, empathize, and connect at a human level.

Francisco Santolo

RELATED BOOKS WE RECOMMEND

"100 Baggers: Stocks That Return 100-to-1 and How to Find Them" by Christopher W. Mayer

While "Dead Companies Walking" delves into the world of short selling, "100 Baggers" provides a contrasting view, focusing on long-term investment strategies for extraordinary gains. This book complements Fearon's by exploring the other side of the investment spectrum, offering insights into what makes companies not just survive but thrive spectacularly. It's a valuable read for understanding the characteristics of high-performing companies and the patience required in investment strategies.

"Billion Dollar Lessons: What You Can Learn from the Most Inexcusable Business Failures of the Last 25 Years" by Paul B. Carroll and Chunka Mui

"Billion Dollar Lessons" is a perfect complement to "Dead Companies Walking" as it dives into some of the biggest business failures. While Fearon focuses on the reasons behind the downfall of companies from an investor's perspective, "Billion Dollar Lessons" provides a broader view of strategic missteps and managerial errors that led to these failures. This book is crucial for readers interested in learning from the mistakes of others to avoid similar pitfalls in their business ventures.

"How the Mighty Fall: And Why Some Companies Never Give In" by Jim Collins

"How the Mighty Fall" examines why once-successful companies decline and how they can either recover or continue to fall. This book echoes the themes in "Dead Companies Walking" by exploring the stages of decline in great companies. Collins' insights into the reasons for corporate failures complement Fearon's by providing a structured framework for understanding how and why companies lose their edge. It's an insightful read for anyone seeking to understand the warning signs of business decline and how to avoid them.